within last week of April only, to avoid tax deduction.

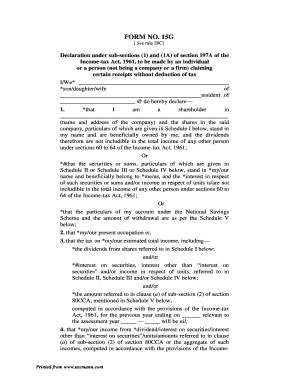

Ideally, you should submit the Form 15G or Form 15H along with the PAN card copy (failing which the deductor will deduct tax at 20%) at the beginning of the financial year i.e. In case you forgot to submit or submit the form 15H or form 15G after deduction, to the deductor then you have to file ITR and ask for a refund. Frequently Asked Questions related to Form 15G and Form 15H For example, if the interest earned from corporate deposits exceeds Rs.5,000 than TDS is to be deducted at 10% irrespective of any age. For Senior and Super Senior Citizens, the threshold limit of TDS is Rs.50,000 for a financial year.įor any other deposits, the threshold limit is Rs.5,000. TDS is deducted at the rate of 10% on the interest income earned on an investment in bank fixed deposits, recurring deposits, deposits in co-operative societies and post if the accumulated interest exceeds Rs.40,000 in a financial year (the earlier limit was Rs.10,000 for a financial year). Must be an individual who has attained the age of 60 years or more (senior citizens or super senior citizens).Must be an Indian Resident (NRIs cannot submit form 15H).The aggregate of the Interest received does not exceed the basic exemption limit for the financial year.Tax liability on the Total Income should be Nil for the Financial Year.Any assessee, other than a company or a firm.Must be an Indian Resident (NRIs cannot submit form 15G).senior citizens while Form 15G is to be submitted by other eligible assessees. a.Form 15H is to be submitted by an Individual Resident of India who has attained the age of 60 years or more during the previous year i.e.Declaration from the Nominee - Locker (DECEASED) Declaration from the Nominee - Account (DECEASED)

c) Form A2 + LRS declaration for online submission (LRS purpose S0001/S0002: Indian Portfolio investment abroad – Equity shares/debt instruments and S0023: Opening of foreign currency account abroad with a bank.).b) Form A2 + LRS declaration: Declaration for remittances under LRS.a) Form A2 : Declaration cum Undertaking FEMA ACT 1991 and Apply for Remittance abroad Form 60 : Declaration for Person without a Permanent Account Number (PAN) Refer the demo Document Upload Functionality Video for instructions on the same Upload Form 15G Instruction easily through the Document Upload module on Citibank Online.

0 kommentar(er)

0 kommentar(er)